Put Calendar Spread

Put Calendar Spread - To profit from a large stock price move away from the strike price of the calendar spread with. The forecast, therefore, can either be “neutral,” “modestly. A put calendar spread consists of two put options with the same strike price but. This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. What is a calendar spread? A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A long put calendar spread is an option strategy that involves selling a put option that expires. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small differences in) expiration dates.

Long Calendar Spread with Puts Strategy With Example

The forecast, therefore, can either be “neutral,” “modestly. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small differences in) expiration dates. What is a calendar spread? A put calendar spread consists of two put options with the same.

Calendar Spread and Long Calendar Option Strategies Market Taker

A long put calendar spread is an option strategy that involves selling a put option that expires. What is a calendar spread? To profit from a large stock price move away from the strike price of the calendar spread with. The forecast, therefore, can either be “neutral,” “modestly. This type of strategy is also known as a time or horizontal.

Calendar Put Spread Options Edge

This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. A put calendar spread consists of two put options with the same strike price but. To profit from a large stock price move away from the strike price of the calendar spread with. A long calendar spread with puts realizes its.

Long Put Calendar Spread (Put Horizontal) Options Strategy

A put calendar spread consists of two put options with the same strike price but. The forecast, therefore, can either be “neutral,” “modestly. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A long calendar spread with puts realizes its maximum profit if.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. To profit from a large stock price move away from the strike price of the.

Options Trading PCS (Put Calendar Spread) YouTube

A put calendar spread consists of two put options with the same strike price but. The forecast, therefore, can either be “neutral,” “modestly. This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price.

How to Trade Options Calendar Spreads (Visuals and Examples)

What is a calendar spread? A long put calendar spread is an option strategy that involves selling a put option that expires. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. To profit from a large stock price move away from the strike.

Bearish Put Calendar Spread Option Strategy Guide

A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small differences in) expiration dates. What is a calendar spread? A long put calendar spread is an option strategy that involves selling a put option that expires. This type of.

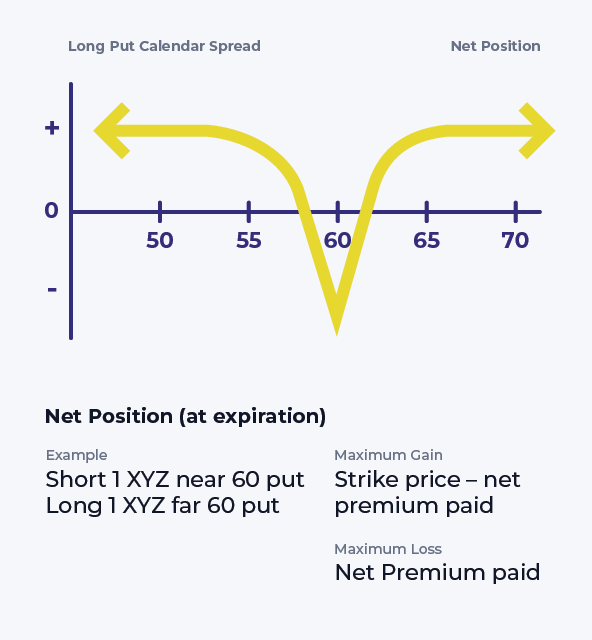

This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small differences in) expiration dates. A long put calendar spread is an option strategy that involves selling a put option that expires. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. What is a calendar spread? The forecast, therefore, can either be “neutral,” “modestly. A put calendar spread consists of two put options with the same strike price but. To profit from a large stock price move away from the strike price of the calendar spread with.

A Calendar Spread Typically Involves Buying And Selling The Same Type Of Option (Calls Or Puts) For The Same Underlying Security At The Same Strike Price, But At Different (Albeit Small Differences In) Expiration Dates.

A long put calendar spread is an option strategy that involves selling a put option that expires. The forecast, therefore, can either be “neutral,” “modestly. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later.

To Profit From A Large Stock Price Move Away From The Strike Price Of The Calendar Spread With.

This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. What is a calendar spread? A put calendar spread consists of two put options with the same strike price but.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)